About the AuthorVisit 123OnlineTrading.com - Options, Stocks, Forex to find books, tips and advice about online options trading. Besides a large selection of free educational articles you can also find powerful books about online trading in general. Other Resources: 123OnlineStockTrading.com - Stock Trading Links

Money Tips, Investing News, Insurance, Mortgage, Credit, Debit, DIY Spreadsheets and Online Calculators

Friday, July 31, 2009

Options Trading Strategies, Basic Concepts

About the AuthorVisit 123OnlineTrading.com - Options, Stocks, Forex to find books, tips and advice about online options trading. Besides a large selection of free educational articles you can also find powerful books about online trading in general. Other Resources: 123OnlineStockTrading.com - Stock Trading Links

Debt Advice For People With Poor Credit

About the AuthorIf you have a poor credit rating and would like some debt advice, visit the experts at www.debt-free.org.uk

Seven Types of Loss Mitigation During Foreclosure

But under this category of loss mitigation fall a number of solutions to foreclosure that may apply in various circumstances. Some lenders may not offer each of these solutions right from the start of negotiations, but homeowners can always request more information about them if they believe one may be appropriate for their foreclosure situation. The seven solutions detailed below are typically classified as loss mitigation.

Cash for keys. In a cash for keys agreement, homeowners are offered a set amount of money from their bank to move out. The offer is usually presented by mail or in person through a local third party, such as a real estate agent or law firm. Banks offer such solutions in order to negotiate a peaceful transfer of a foreclosed home and give the former owners some cash in their pockets for moving expenses.

Deed in lieu. A deed in lieu of foreclosure can be given to the lender by homeowners who are just trying to unload the house, avoid foreclosure, and move out. Borrowers offer to give the deed to the property back to the bank in return for the mortgage company not going through with the foreclosure process. At that point, the bank would be able to list the house for sale and attempt to recoup some of its losses.

Loan modification. Much press has given to the idea of modifying mortgages that are in foreclosure. There are a vast number of ways to do this, from lowering the interest rate to extending the repayment period of the mortgage. The only real drawback to this solution is that banks are rarely that enthusiastic about modifications, because a properly structured one will benefit homeowners more than lenders.

Partial claim. For homeowners with a mortgage guaranteed by the FHA, a partial claim may be used to give the bank a one-time payment from the government in order to stop foreclosure. In exchange, a lien is placed on the property, although the lien has a zero percent interest rate and does not have to be paid back until the first mortgage is paid off or the home is sold or ownership is otherwise transferred.

Short sale. A short sale allows borrowers to sell their property for less than the total amount that they owe to the lender. All of the mortgage companies have to accept a reduced payoff for the sale to close, or the homeowners will have to bring cash to closing to pay off any remaining liens. While this can help borrowers avoid losing their homes, banks are not very quick to approve short sales.

Short refinance. With this method, the bank agrees to lower the total due on the mortgage in order to facilitate a refinance through another lender. Oftentimes, homeowners may be approved for a certain amount of money to refinance, but the amount they owe on the first mortgage along with fees and unpaid interest makes it impossible. A short refinance allows the refinance to go forward and the foreclosure to be ended.

Special forbearance plan. Under a special forbearance, homeowners can make a lower payment or have no payment at all for a certain period of time. This can be more easily negotiated well before homeowners default, as banks will not be fond of borrowers who ask for lower payments after they have begun missing them. In addition, the homeowners will eventually need to pay back any payments they missed.

Homeowners facing foreclosure have the problem of not knowing what options may be appropriate for their individual situations. And unfortunately, the lenders are often no help, pushing borrowers into expensive repayment plans or filing fraudulent lawsuits alleging foreclosure. However, the more that they know about various solutions that will help them save their homes, the less stressful the situation will be.

About the Author/Author Bio

Nick publishes articles on the ForeclosureFish website, which aims to teach borrowers how they can avoid on their homes while they still have time. The site describes various methods to save a house, including foreclosure refinancing, cash for keys, mortgage modification, filing bankruptcy, and more. Visit the site today to read more and find out what alternatives you can use to prevent the loss of your home: http://www.foreclosurefish.com/

Saturday, July 25, 2009

The Clear Benefits of Loan Consolidation by Scott Fromherz

Debt consolidation is usually considered when people feel squeezed financially. It can often save them from financial disaster. However, debt consolidation should not only be considered as an emergency measure to resuscitate finances that have flat-lined (or for rescuing those that are about to), it is a strategy that should be considered by anyone with multiple sources of debt to reduce expenses and save money. The difference between consolidating or not consolidating debt could be your child having a college loan versus a paid education, driving a quality car versus a bomb, owning your home in twenty years instead of thirty or countless other possibilities. Even if you can easily cover all your debt repayments, your overall financial position can improve with debt consolidation.

For those who are enduring financial pain, however, debt consolidation can provide a much needed miracle. It can take pressure off the finances by freeing monthly income and making it easier to cover current expenses. For many people, debt consolidation has prevented foreclosure on their family home and has stopped the debt collectors in their tracks.

Serious financial stress can place a great deal of strain on relationships and plant the seeds of family breakdown. It can also lead to serious stress related illnesses. The benefits of debt consolidation, therefore, are far reaching. The decision to consolidate your debts could save your marriage and keep your family together. It could also prevent you or family members from becoming so stressed you get seriously ill.

Even if your financial circumstances are not so severe, debt consolidation can increase your expendable income which can then be used to reduce debt faster, increase savings and investments or simply to improve the quality of your life. After all, doesn't it make sense that more of your money should stay in your pocket and less go to financial institutions? The long term savings in terms of interest payments can also be very significant and therefore your long term financial position will benefit from effective debt consolidation.

There are number of different debt consolidation loans to choose from. If you are a homeowner with enough equity in your home, probably the best loan for this purpose is a home equity loan. This is because it usually offers a lower interest rate than other loans available to you. A home equity loan used to be known as a second mortgage and the risk is more easily seen with the old term. The loan is attached to your mortgage which means that if you miss a payment, you are vulnerable to losing your house. However, this is unlikely since by consolidating your loans, your monthly expenses will decrease making payments easier.

The most popular way to consolidate loans is to use a personal loan. Personal loans are usually unsecured which means that you do not need to provide collateral in order to obtain the loan. They usually have lower interest rates than other consumer loans and fixed terms so that the debt will be finalized by a particular date.

Low rate credit cards and home equity lines of credit can also be used as debt consolidation loans. However, the risk with these loans is that you can actually increase your debt levels if the card has a higher limit than your current debt or at the very least spend up to the current limit. If you do this, you'll never get out of debt. Yet, even knowing this, if we are under financial pressure most of us will use whatever we can to alleviate it. Therefore, these loans are best used if the debt consolidation is for a specific and ongoing purpose such as medical or education expenses that could not have been met without the loan.

Of course, as with any financial decision, it is important to check into your options carefully. Some loans will be better than others for your personal circumstances. A good adviser can help you find the right loan to meet your needs and may even be able to advocate for you with your lenders to smooth the process and alleviate stress. Whether you choose to handle your debt consolidation yourself or to seek the help of a professional, the right debt consolidation loan will provide clear benefits that can vastly improve your life.

For more information on loan consolidation go to http://www.ConsolidationFind.com

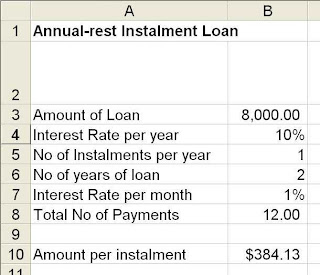

Loan Amortization For Year-rest Installment Loan

Suppose if you would like to apply for a two-year loan of $8,000 at 10% per annum. To work out the monthly installment amount:

1) In Cell A1, type " Annual-rest Installment Loan"

2) In A3, type "Amount of Loan".

3) In B1, type "8,000"

4) In A4, type "Interest Rate per year"

5) In B4, type "10%"

6) In A5, type "No. of Installments per year."

7) In B5, type "2"

8) In A6, type "No of years of loan"

9) In B6, type "2"

10) In A7, type "Interest rate per month"

11) In B7, type "=B4/12"

12) In A8, type "Total number of installments"

13) In B8, type "12"

14) In A10, type "Amount per installment ="

15) In B10 , type "=PMT(B4,B6,-B3,0,0)"

The amount that you would have to pay for the installment is $384.13 per month.

1) In D1, type "Loan Amortization Schedule"

2) In E2 , type "Principal at beginning of month"

3) In F2, type "Interest due at end of month"

4) In G2, type "Installment Payment"

5) In H2, type "Principal Repaid"

6) In D3, type "=1"

7) In E3, type "B3"

8) In F3, type "$B$7*E3". Copy this formula from F4 to F26

9) In G3, type "=B10"

10) In H3, type "0". Copy this value from H4 to H13 and H15 to H25

11) In H12, type " =SUM(G3:G14)-SUM(F3:F14)". Copy this formula to H26

12) In D4 to D26, type 2 all the way to 24

13) In E4, type "E3-H3". Copy this formula from E5 to E26

14) In G4, type "=G3" and copy this formula from G4 to G24

The final result will look something like this:

Disclaimer: Please note that aside from the schedule above, there might be other charges by the bank such as admin fee, processing fee etc. Do check with your bank officer or financial planner before making any decision to go ahead with any bank loans.

Saturday, July 18, 2009

Loan Amortization For Monthly-Rest Installment Loan

This blog will teach you how to work out a rough schedule on working out a monthly-rest installment loan. A monthly-rest loan is a loan where the principal amount is reduced on a monthly basis. To work out a schedule for this type of loan, you must first work out how much is the monthly installments. To do this, open a spreadsheet and do the following below. Remember to follow each step as it says or the formula will not work.

Suppose if you would like to apply for a two-year loan of $8,000 at 10% per annum. To work out the monthly installment amount:

1) In Cell A1, type " Monthly-rest Installment Loan"

2) In A3, type "Amount of Loan".

3) In B1, type "8,000"

4) In A4, type "Interest Rate per year"

5) In B4, type "10%"

6) In A5, type "No. of Installments per year."

7) In B5, type "12"

8) In A6, type "No of years of loan"

9) In B6, type "2"

10) In A7, type "Interest rate per month"

11) In B7, type "=B4/B5"

12) In A8, type "Total number of installments"

13) In B8, type "B6*B5"

14) In A10, type "Amount per installment ="

15) In B10 , type "=PMT(B7,B8,-B3,0,0)"

The amount that you would have to pay for the installment is $369.16 per month.

To work out the loan amortization schedule, in the same spreadsheet, do the following:

1) In D1, type "Loan Amortization Schedule"

2) In E2 , type "Principal at beginning of month"

3) In F2, type "Interest due at end of month"

4) In G2, type "Installment Payment"

5) In H2, type "Principal Repaid"

6) In D3, type "=1"

7) In E3, type "B3"

8) In F3, type "$B$7*E3". Copy this formula from F4 to F26

9) In G3, type "=B10"

10) In H3, type "G3-F3". Copy this formula from H4 to H26

11) In D4 to D26, type 2 all the way to 24

12) In E4, type "E3-H3". Copy this formula from E5 to E26

13) In G4, type "=G3" and copy this formula from G4 to G24

The final result will look something like this:

You may change the figures in B3, B4 and B6 to see how this schedule changes together with the monthly payments payable. If you have to change the number of years, don’t forget to change the column on the number of payments to (12 * number of years).

Disclaimer: Please note that aside from the schedule above, there might be other charges by the bank such as admin fee, processing fee etc. Do check with your bank officer or financial planner before making any decision to go ahead with any bank loans.

In the next blog, we will discuss annual -rest loan schedules. See you around when I post my next blog.

Saturday, July 11, 2009

Time Value of Money : Future Values

In this blog, we'll explore how to use a spreadsheet to calculate future values without dealing with any complicating formulas. Just follow the instructions step by step and you will never go wrong.

Future Value of a Single Payment

1) In A1, type "Interest Rate Per Year"

2) In A2, type "No of years"

3) In A3, type "Value In the present day"

4) In A5, type " Future Value = "

5) In B5, type "= FV(B1,B2,0,B3)"

Suppose if you would like to put $10,000 into a one year fixed deposit that pays an interest of 5%. To find the future value of this deposit i.e, the value of the deposit on the day the fixed deposit matures, do the following:

1) Type 5% in B1

2) Put 1 in B2

3) In B3, type -$10,000

The future value will be reflected as $10,500. The final result will look like this:

Try changing the values in B1, B2 and B3 to watch how the future value changes.

Future Value of a series of payments

To find the future value of a series of payments, do the following:

1) In A1, type "Interest Rate Per Year"

2) In C1, type "If you're workign with months, divide this figure by 12)

3) In A2, type "No of years"

4) In C2, type "If you're working with months, multiply this figure by 12)

5) In A3, type "Amt Per Payment"

6) In A4, type "Arrears/Due"

7) In C4, type "(Key in 0 if the payment is made in the beginning of the period and 1 for the end of the period)"

8) In A6, type "Future Value = "

9) In B6, type "=FV(B1,B2,B3,0,B4)"

Suppose if you have to deposit $1000 at the end of every year for 5 years at an interest of 4%. To find the future value of this investment, do the following:

1) In B1, type 4%

2) In B2, type 5

3) In B3, type -1000

4) In B4, type 1

The future value of this investment will be worth $5,632 and the result will look something like this.

Try changing the values in B1, B2, B3 and B4 to see how the future value changes.

I hope that you found this blog useful.

Time Value of Money - Present Values

If you hate figures and are not very good with the calculator, then you've come to the right page. In this blog we'll learn how to calculate the present value of an amount without all those complicating formulas that you see in most finance textbooks. All you need to do is to open up a spreadsheet and you're ready. Just follow the step by step instructions on setting up the spreadsheet and you're on your way to working out the figures in a jif. Please note that the following instructions will only work if you follow the steps exactly as it says.

Present Value of a single payment

To calculate the present value of a single payment. Do the following:

1) In an excel spreadsheet , type "Interest Rate Per Year" in Cell A1.

2) In A2, type "No. of Years"

3) In A3, type "Value in the Future"

4) In A5, type "Present Value = "

5) In B5, type "=PV(B1,B2,0,B3)"

Suppose if you will be receiving $20,000 in a year from now and you would like to find out what this value is worth today if you know that the interest rate is 2%. To do this, you have to do the following:

1) Key in 2% in cell B1.

2) Key in 1 in cell B2 for the number of years.

3) In B3, key in -20,000 as the value in the future. This figure has be keyed in as negative for the answer to work.

The present value will be $19,607.84. This is what the $20,000 of the future is worth right now. The final result will look something like this:

Try experimenting a bit by changing the interest rate, amount or number of years and watch the present value figure change. Now wasn't that easy?

Present Value of a series of payments

To work out the present value of a series of payments, do the following:

1) In A1, type "Interest Rate Per Year"

2) In C1, type "(If you're working with months, divide this figure by 12)"

3) In C2, type "(If you're working with months, multiply this figure by 12)"

4) In A2, type "No of Years"

5) In A3, type "Amt Per Payment".

6) In A4, tyep "Arrears/Due"

7) In C4, type "(Key in 0 if payment is made beginning of the period or 1 for end of the period)"

8) In A6, type "Present Value = "

9) In B6, type "=PV(B1,B2,B3,0,B4)"

To illustrate an example, if you have to make a payment of $1000 at the end of each year for the next 5 years with an interest rate of 4% and you would like to know what will the total value of the figure be as at today. Do the following:

1) In B1, type 4%

2) In B2, type 5

3) In B3, type -1000

4) In B4, type 1 because payment is made at the end of the year and not the beginning of the year.

The present value that you will get is $4,629.90. The final answer will look something like this:

Try changing the interest rate or number of years or even the amount per payment to see how the present value changes.

I hope that you find this blog useful. In my next blog, I will cover future values.